Der Covered Call (gedeckter Call) bedeutet nichts anderes, als dass der Besitzer von einem Underlying (Aktien, ETFs etc.) den Basiswert in seinem Portfolio hat und darauf eine Call Option verkauft.

Covered Call Trader kaufen ein Underlying ( Aktie, ETFs) und verkaufen häufig sofort Calls des Basiswertes (üblicher Weise über dem Einstiegskurs) um Prämien einzunehmen.

Solange die Aktien sich im Besitz des Covered Call Verkäufers befinden hat er auch Anspruch auf Einnahmen von Dividenden, so dass häufig Zusatzeinnahmen generiert werden.

Die Covered Call Strategie ist eine der einfachsten Strategien die von vielen Tradern angewendet werden (auch von Warren Buffet). Sie dient nicht nur zu Prämieneinnahmen sondern ist auch ein probates Mittel um aus einer Aktie auszusteigen.

Ein Wall Street Spruch lautet: „There is no free lunch“ und so hat auch diese Strategie eine Kehrseite der Medaille wie wir an unserem Beispiel an zwei Positionen sehen werden, die wir selbst in unserem Portfolio halten.

We became aware of the stock as part of our research, the fundamental analyses we conduct, but also due to positive news and analyst assessments.

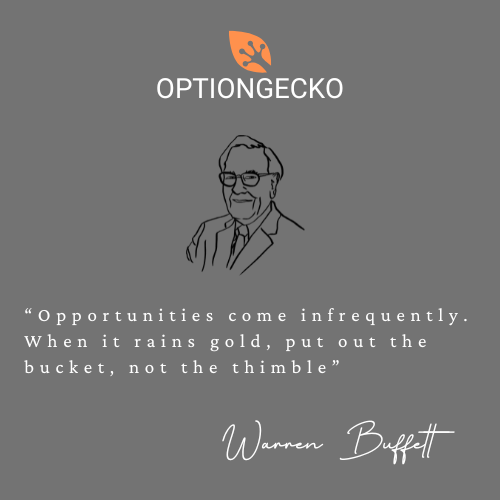

XPEV is a Chinese Tesla rival that also invests in autonomous driving systems, has a partnership with Didi and also invests in flying vehicles.

VW has invested 4.99% in XPEV (German car manufacturers are now buying up know-how in China) and a new Mona model has been introduced, which is on a par with Tesla and costs only half as much. The model was pre-ordered 10,000 times in 52 minutes!

JP Morgan had upgraded the stock to $11 and we decided to enter based on the overall picture and bought 1000 shares of this stock. Immediately after the purchase we sold

3 call contracts on the strike price of $11 at $52 per contract with expiry Dec 20´24 and thus received $156 in premiums.

3 call contracts on the strike price of $11 at $66 per contract with expiry Jan 17’25 and thus received $198 in premiums.

Since we own the shares, this is a covered call.

The trade has developed very well and the stock is up +47.1% today at the time of writing this article, November 7, 2024. The stock closed yesterday at $12.92 and we will most likely (have to) sell 60% of our portfolio at $11. We have received very good and high premiums (5-6%), which is not always possible. The downside of covered calls is that in some cases you have to sell some of your profit because you cannot see into the future.

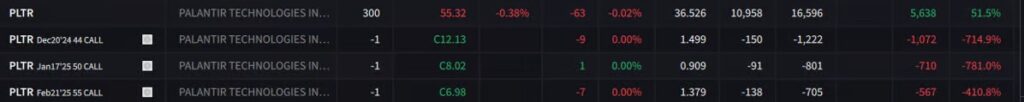

It was similar with Palantir. We sold covered calls at 44.50 and 55 with different expiries. The stock is trading at $55.29 and we will probably have to sell the shares.

In this case, it is easy to cope with: we will most likely realize a profit of +25% and more for 3-4 months, but it could have been more.

We are not mourning the loss because as a covered call trader you learn to deal with it, it is part of this wonderful game.